About Estate Planning Attorney

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is DiscussingSee This Report about Estate Planning AttorneyFacts About Estate Planning Attorney UncoveredUnknown Facts About Estate Planning Attorney

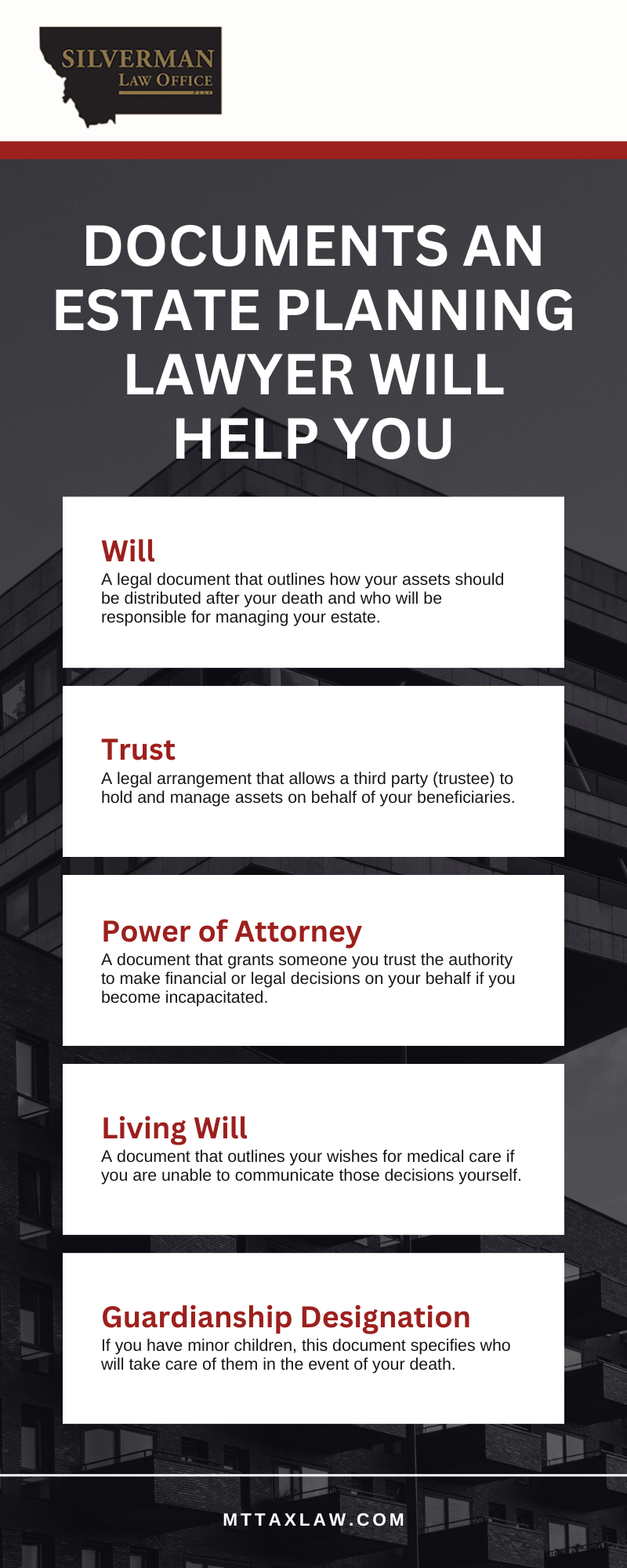

Estate planning is an activity strategy you can utilize to identify what happens to your possessions and commitments while you're alive and after you die. A will, on the various other hand, is a lawful paper that describes exactly how properties are dispersed, who cares for youngsters and animals, and any type of various other dreams after you die.

Insurance claims that are rejected by the executor can be taken to court where a probate court will certainly have the final say as to whether or not the insurance claim is valid.

The Estate Planning Attorney Ideas

After the supply of the estate has been taken, the value of possessions computed, and taxes and financial debt settled, the administrator will certainly then seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any type of estate tax obligations that are pending will certainly come due within 9 months of the day of fatality.

Each specific areas their properties in the trust fund and names somebody various other than their partner as the recipient., to sustain grandchildrens' education.

The Basic Principles Of Estate Planning Attorney

Estate organizers can function with the contributor in order to decrease taxed income as a result of those payments or create strategies that optimize the effect of those donations. This is an additional method that can be utilized to limit death tax obligations. It includes an individual securing the existing value, and hence tax obligation liability, of their home, while attributing the worth of future growth of that capital to an additional person. This approach includes freezing the worth of an asset at its worth on the date of transfer. As necessary, the amount of possible funding gain at fatality is likewise iced up, enabling the estate planner to estimate their possible tax obligation liability upon fatality and far better prepare for the settlement of earnings tax obligations.

If adequate insurance proceeds are available and the policies are properly structured, any type of revenue tax on the regarded dispositions of possessions adhering to the death of a person can be more paid without considering the sale of assets. Profits from life insurance that are gotten by the recipients upon the death of the insured are usually income tax-free.

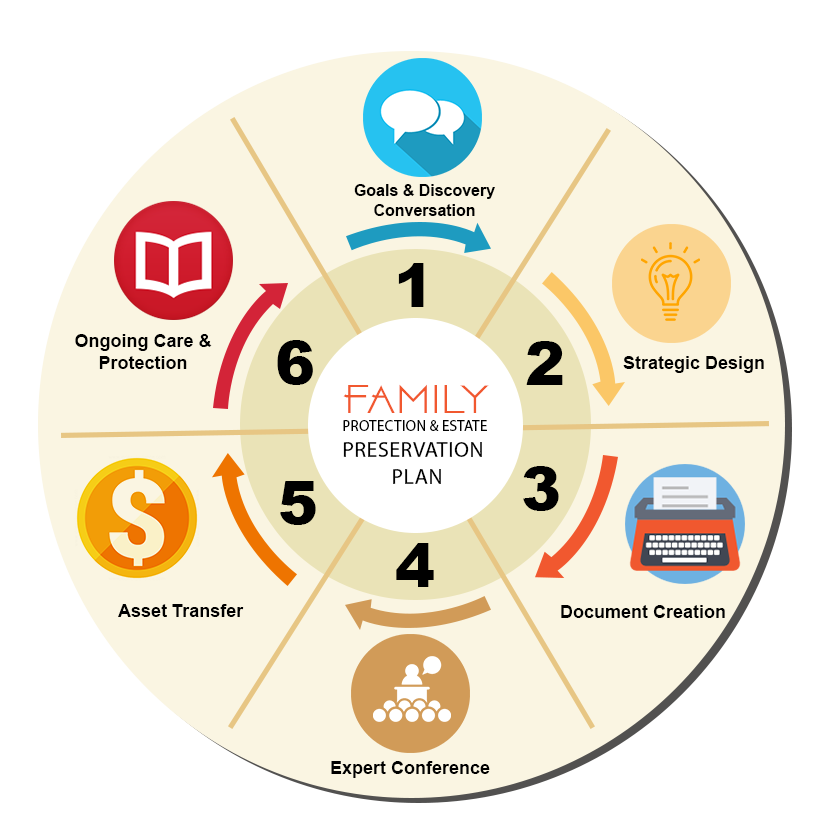

Other charges related to estate planning include the prep work of a will, which can be as reduced as a few hundred dollars if you make use of among the best online will manufacturers. There are particular documents you'll need as component of the estate preparation procedure - Estate Planning Attorney. Some of the most typical ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate preparation is just for high-net-worth people. Estate intending makes it less complicated for people to identify their desires before and after they die.

The Estate Planning Attorney Diaries

You should begin preparing for your estate as quickly as you have any kind of quantifiable asset base. It's a recurring process: as life proceeds, your estate plan ought to move to match your circumstances, in line with your brand-new goals. And maintain at it. Refraining from doing your estate planning can create undue economic problems to loved ones.

Estate planning is usually thought of as a tool for the affluent. Estate preparation is also a terrific means for you to lay out strategies for the care of your minor kids and family pets you can check here and to detail your wishes for your funeral and preferred charities.

Applications should be. Qualified applicants that pass the examination will certainly be officially licensed in August. If you're eligible to rest for the examination from a previous application, you might file the brief application. According to the guidelines, no qualification shall last for a duration longer than 5 years. Locate out when your recertification application is due.